The GameStop Drama Is Heading To Congress

GameStop once had thousands of brick and mortar locations throughout the world, according to archived news releases from the company. Unfortunately, some started to vanish as GameStop's customer base shifted to digital stores for their products. GameStop's fortunes changed dramatically in January when the Reddit group r/WallStreetBets organized a "short squeeze" on Wall Street investors who'd been betting against GameStop's prices. GameStop's stock skyrocketed to more than $300 per share, despite being at less than $5 per share during the summer.

Now Congresswoman Maxine Waters wants Redditor and r/WallStreetBets messiah Keith Gill — a.k.a. DeepF****ingValue – to testify before Congress on Feb. 18 about what went down. Waters (D-California), who chairs the House Committee on Financial Services, told Cheddar TV on Wednesday that the hearing would provide all of the actors in the recent stock market drama the chance to make their case.

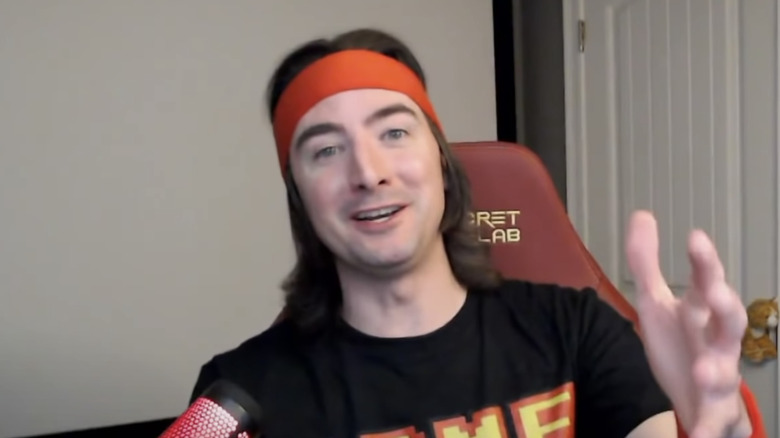

Gill, 34, who has worked as a financial adviser and YouTuber under the moniker Roaring Kitty, is considered the mastermind behind the surge in GameStop's stock value. Gill's leadership on the WallStreetBets subreddit helped to meme-ify GameStop and increase the company's stock prices to unimaginable highs, earning retail investors millions of dollars at the expense of Wall Street hedge fund managers. According to The New York Times, which described him as an "online folk hero," Gill has also attracted the eyes of financial regulators in his home state of Massachusetts.

"I have him on my list to be present. They have not confirmed all of my list yet, but I want him," Waters told Cheddar. "I even want to have GameStop here."

Additionally, Waters said she wants to have representation from hedge fund managers at the hearing, as well as Robinhood investment app CEO Vladimir Tenev. Robinhood incensed retail investors when it abruptly limited trading on GameStop stock last week. Tenev has been criticized for his relationship with hedge funds Citadel and Melvin Capital, according to Bloomberg.

"We want to know about the relationship with Citadel, and we want to know exactly whether or not that relationship undermines its ability to have this platform available for these small retailers in a way that they think it is available to them," Waters said. She also said she wasn't sure how the Securities and Exchange Commission would handle the issue. "I don't think it's easy to regulate at all," Waters said, later adding, "We don't know how much the SEC is going to be engaged in this. This is all new. We're going to try and find out."

Waters said she isn't taking sides yet and that the hearing will "be a learning experience for everybody."

"We're open-minded, we're gonna listen," she said.